Sell to Survive: The EFL Conundrum & The Hidden Cost of Bazball?

Millwall have had one of their best seasons on and off the pitch, but is selling your best talent to balance the books the model clubs want to rely on to survive?

The Championship…it’s a strange beast. A paradox even.

The primary objective and marker of success for anyone competing in it is to leave it. Yet it’s also a league with top talent, big revenues, and a significant media deal building both exposure and commercial value.

But in this high-octane, promotion-obsessed second tier of English football, the romance of ambition often collides with the cold truth of finance.

While the Premier League dangles £100+ million golden tickets, the financial reality for most Championship clubs is far less glamorous. With key revenue streams (media, commercial, matchday) falling further behind spiralling costs (transfer fees, wages, operations) many clubs are left with one viable path to financial stability: sell to survive.

Mark Fairbrother is the Managing Director of Millwall. He is in charge of delivering a progressive and innovative sports business while showcasing elite performance capable of competing at the top level of English football.

In what was a revealing conversation on this week’s show, Mark made a comment that really stood out:

“When you're in an environment where everyone is increasing spend and everyone is out for the best players, you have to compete. So the last couple of years, our losses have increased. This year, we've had a couple of player sales, so it may be our first profit in at least 20 odd years…but of course it reflects the fact that we had two player sales! And unfortunately for Championship clubs, that is the only way you can build sustainability from a P&L point of view as it stands”

Mark Fairbrother —

Millwall’s first profit in however many years will be the result of one major factor:

Romain Esse — Millwall → Crystal Palace (£14m)

Zian Flemming — Millwall → Burnley (£7m)

Previous Year’s Operating Loss: £19.1 million

Dependent on deal structure and viewing it holistically, these sales balance the books + VAT. We like to call this the ‘football lottery’: mind-bending when it comes off, but winning it cannot be relied on to underwrite your outgoings.

Not to mention, the funny thing about player trading? It can be great for business but problematic for ambition in the Championship. If you want to reach the top you need to be operating on the buy side, not the sell side, and short of a few exceptional examples, the buy side requires a chunky wallet.

The Premier League’s wealth creates a gravitational pull that warps financial discipline. Clubs spend beyond their means chasing that golden ticket.

2023/24* Championship numbers highlight the issue: £958m revenue (28% yoy growth) > losses over £400m…a collective cost base almost 50% higher than their income, and the income has grown notably!

And it’s no surprise to see revenue increasing alongside cost. As soon as clubs get access to more money, they spend it on transfer fees and wages; they create the inflation that puts them most at risk.

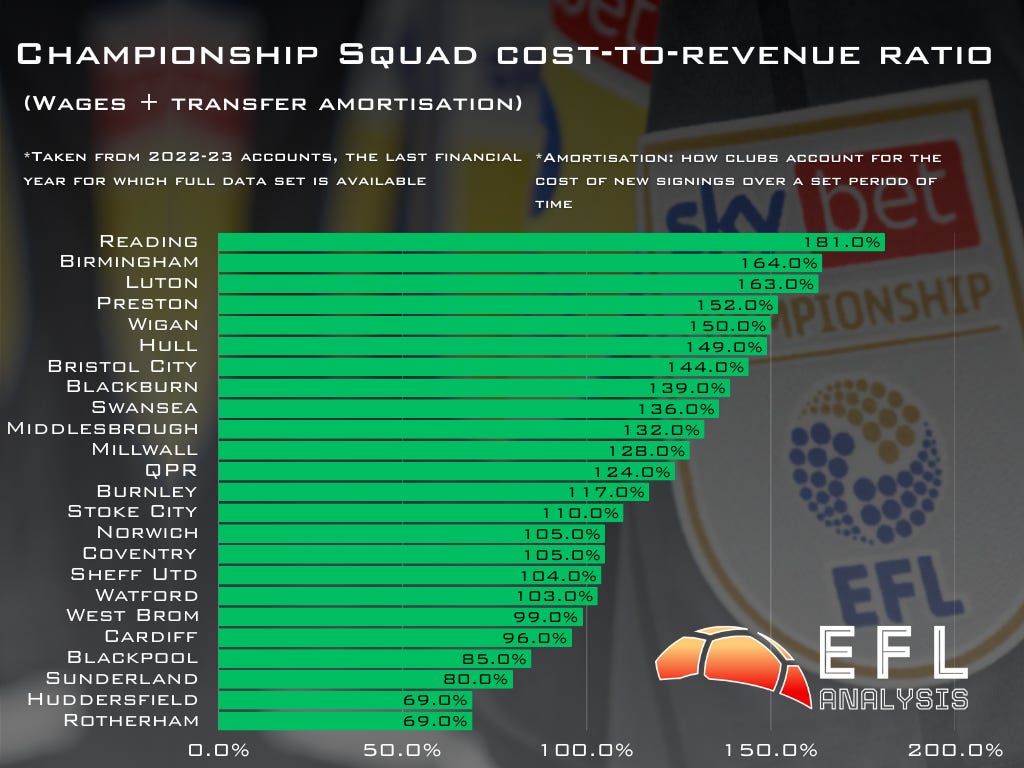

The above graphic (while a couple of years old), is evidence of the perilous position many teams are putting themselves in. Maybe unsurprising that a club in recent crisis sits at the top of this list…

Those losses are covered by club owners. If they weren’t, clubs would go out of business…there is no fancy way of dressing this up. Football clubs are as sustainable as their owner’s willingness to bankroll them.

And as Millwall can attest to this season, the way to remove this ask of the ownership in a short timeframe is to sell key players. But having done that are Millwall capable of building on the hugely promising 8th placed finish they achieved this year?

Brighton are the storied experts at this: source exceptional (and undervalued) talent, nurture it, sell it, maintain performance…but the key to this is to already have your replacement identified with deal agreed or in the squad quietly making moves already.

In short, the market cannot take advantage of the fact you’re cashed up and in need of talent. They’re the exception not the rule.

So what are we trying to say because this whole environment is just full of contradictions…

With Millwall as our case study, they can masquerade as sustainable if they sell players. It improves the bottom line but compromises ambition. It is also not a reliable source of income. If a team cannot generate £20m+ in sales and is losing that amount and some, this house of cards will eventually start to lose some of it’s key pillars.

*Most recent complete financials available

Catch the show on Apple & Spotify

OPINION PIECE

The Lost Revenue of Bazball?

Are we even allowed to call it that? ‘Bazball’ is many things…aggressive, unpredictable, thrilling, and expensive (if you are part of the stakeholder group relying on test matches to last a full 5 days to maximise revenue).

Now the last thing we want is dreary 5-day test matches for the sake of it. I was in Barbados for England vs West Indies in 2022. They’d prepared a road, 5 days almost guaranteed, Brathwaite faced 489 balls for 160 runs, the fans drained the rum punch. Maximum commercial value achieved…but pretty painful.

But those days are long gone. This is a team of first day declarations and reverse sweep addictions. Play the game on the front foot, play it with flare. Joe Root ramping Pat Cummins first ball of his innings in a crucial Ashes test… ‘we’re here for a good time not a long time’.

And then England and India serve up that spectacle; ‘Bazball with brains’ subsequently flying round the airwaves.

A full test match. Maximum entertainment. Financial optimisation achieved. It’s great for cricket; it’s great for the bank. Or is it? Let’s look at why losing ‘Day 5’ (or *whisper it* Day 4) matters financially:

Lost tickets & hospitality – Up to £4 m disappears when Day 5 vanishes at Lord’s.

Broadcast rebates – Sky / ICC event contracts include pro-rata ‘overs delivered’ clauses; counties lose a small slice of rights revenue if the Test is short by >75 overs.

In-ground spend – Merchandise and F&B can add 10-15 % on top of the gate.

Sponsorship make-goods – Some perimeter-board and on-air sponsors trigger credits if exposure hours fall below target.

Between 2010-2020, England played 116 tests, with 69 (59%) going to a fifth day. They have played 36 test matches under Brendon McCullum. 8 have gone to a fifth day. That’s 22%. In short, not a lot.

Of all the non-England tests in the same timeframe, 38% went the distance.

Many of these matches have been scintillating; a premium advert for a format of the game in need of an injection of excitement.

But with the finances of cricket always teetering on a knife edge, this lost revenue to county grounds can be a pretty serious problem. Times are tough enough without losing a portion of your moment in the sun.

A five day test match against India or Australia can be worth £10-15m to the ECB and associated venues. Estimated daily losses are not insignificant:

Lord’s (31,180 capacity) ~ £3.8m

Edgbaston (25,000) ~ £2.0 m

Headingley / Old Trafford (21–23 k) ~ £1.6–1.7 m

Oval (27,500) ~ £2.3 m

The flip side to this is when a test has two of it’s days on a Monday and Tuesday…not exactly conducive to encouraging full attendances. It’s been roughly accepted that it takes 60% capacity to breakeven for the day. So while the assumption is that losing a day is bad for business, you could easily be stuck in the middle here…

Play the full match with an insufficient last day crowd risking a deficit OR game over in 3/4 days and have to cover the costs listed above. Not the ideal solution to be working with.

But it’s an interesting dilemma England have on their hands; the best marketing tool they have created in years is costing them millions in lost revenue 78% of the time.

If you park the business approach and just go back to the main objective (protecting test cricket), the swashbuckling chaos brought about by this team is worth every top edged hook shot if it helps secure the future of the format in the long run and reminds the young players and fans that this is still the side of the sport to aspire to.

Want to see more from Business of Sport? Visit us across our various platforms linktr.ee/bizofsport

And of course a huge thank you to our amazing partners on the show:

RUNNA

Whether you’re an existing use or if it’s your first time on the app, use the code below for exclusive access!

https://join.runna.com/lKmc/redeem?code=BOSRUNNA

Revolut

Click the link below to sign up and get your £200 welcome bonus!

https://get.revolut.com/z4lF/20VC